Money changes. Bills change. Kids grow. And what worked last year may not work now. That’s why a family budget binder matters. It’s not just paper in a folder. It’s a simple system that helps your family stay organized, avoid surprises, and make better money decisions over time.

If you’ve tried budgeting apps and quit, or spreadsheets that never get updated, a budget binder can be easier. It’s visual. It’s flexible. And it grows with your family.

Here’s how to make one that you’ll actually use.

What Is a Family Budget Binder?

A family budget binder is a physical place to manage your household finances. Everything goes in one spot.

It helps you:

- Track income and expenses

- Plan monthly budgets

- Stay on top of bills

- Save for goals

- Reduce money stress

You don’t need fancy supplies. You just need a clear system.

What You Need to Get Started

Keep it simple.

You’ll need:

- A sturdy binder (1.5–2 inches works for most families)

- Divider tabs

- Printed budget pages or blank paper

- A pen or pencil

- Optional sheet protectors

That’s it. Don’t overbuy. Simple systems last longer.

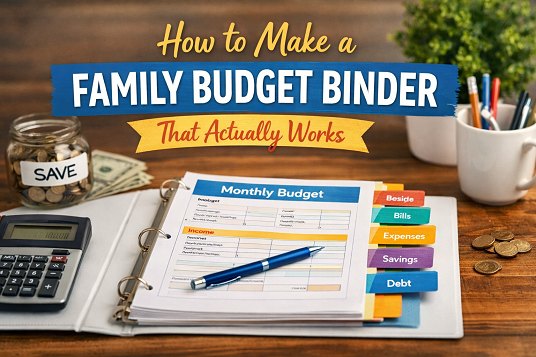

Step 1: Set Up Your Binder Sections

These are the core sections every family budget binder should have.

1. Monthly Budget

This is the heart of your binder.

Include:

- Total monthly income

- Fixed expenses (rent, utilities, insurance)

- Variable expenses (groceries, gas, fun money)

- Savings categories

- Leftover balance

This page shows where your money should go before the month starts.

2. Bills Tracker

This keeps you from missing payments.

Track:

- Bill name

- Due date

- Amount

- Payment status

You can use one page per month or one master list for the year.

3. Expense Tracker

This shows where your money actually goes.

Log:

- Date

- Category

- Amount

- Notes (optional)

Even writing down expenses for two weeks can change spending habits fast.

4. Savings Goals

This keeps you motivated.

Include:

- Emergency fund

- Vacation savings

- School expenses

- Holiday funds

Seeing progress on paper helps you stick with it.

5. Debt Payoff Pages

If you have debt, don’t ignore it.

Track:

- Credit cards

- Loans

- Minimum payments

- Remaining balances

This section helps you see progress, even when it feels slow.

6. Yearly Overview

This is for the big picture.

Include:

- Annual income estimate

- Big upcoming expenses

- Financial goals for the year

Review this section every few months.

Step 2: Choose a Budgeting Method That Fits Your Family

There’s no one right way.

Common options:

- Zero-based budgeting

- Paycheck-to-paycheck budgeting

- Percentage-based budgeting

- Cash envelope style (on paper)

Pick one. Stick with it for at least two months. Then adjust if needed.

Step 3: Make It Easy to Use

If it’s hard, you won’t use it.

Tips:

- Keep the binder in one visible place

- Use simple categories

- Update it weekly, not daily

- Don’t aim for perfection

Missed a week? Just keep going.

Step 4: Involve the Family

Budgeting works better when it’s shared.

You can:

- Review bills together once a month

- Set family savings goals

- Let kids help track simple categories

- Talk openly about money decisions

This builds better habits for everyone.

Common Mistakes to Avoid

Avoid these if you want it to last:

- Making it too complicated

- Tracking too many categories

- Never reviewing past months

- Giving up after one bad month

A budget binder is a tool, not a test.

How Often Should You Update Your Budget Binder?

- Weekly: expense tracking

- Monthly: new budget and bill check

- Quarterly: review goals and categories

- Yearly: reset priorities

Short check-ins work better than long ones you avoid.

Why a Family Budget Binder Still Works Today

Apps are useful. Spreadsheets are powerful. But a budget binder slows you down in a good way. You see your numbers. You think before you spend. And you stay aware of what matters.

It’s flexible enough to change with your family and simple enough to stick with.

Final Thoughts

You don’t need a perfect budget. You need a clear one. A family budget binder gives you control, clarity, and peace of mind. Start small. Build it step by step. And keep using it even when life gets messy.

Grab a binder. Print a few pages. And start this week.

What is a family budget binder?

A family budget binder is a physical system that helps you organize income, expenses, bills, savings, and financial goals in one place. It makes budgeting easier to manage and review.

Do I need a budget binder if I already use a budgeting app?

You don’t have to choose one or the other. Many families use a binder alongside apps. The binder gives you a clear visual overview and helps you stay more consistent.

How much does it cost to make a budget binder?

You can make one for very little money. A basic binder, paper, and dividers are enough. Many families start with free printable pages and upgrade later if needed.

How often should I update my family budget binder?

Most families update it once a week for expenses and once a month for planning. Regular short check-ins work better than long, infrequent reviews.

What sections should every budget binder include?

At minimum, include a monthly budget, bills tracker, expense tracker, savings goals, and debt pages. You can add or remove sections as your needs change.

Is a budget binder good for beginners?

Yes. Budget binders are one of the easiest ways to start budgeting. They don’t require tech skills and help you understand your money faster.

Can a family budget binder help reduce overspending?

Yes. Writing down expenses makes you more aware of spending habits. That awareness alone often leads to better decisions.

Should I involve my kids in the budget binder?

If they’re old enough, yes. Simple involvement helps kids learn money skills early and makes family goals feel shared.

What size binder works best for a family budget?

Most families do well with a 1.5 to 2-inch binder. It gives enough space without becoming bulky.

What if I fall behind on updating my budget binder?

That’s normal. Don’t quit. Just pick it back up and continue from where you are. Consistency over time matters more than perfection.