Frugal living tips for families are no longer optional. For many households, they are necessary. Grocery prices have increased. Utility bills are unpredictable. Everyday expenses quietly rise each year. A typical family of four can spend thousands more annually without changing their lifestyle.

Frugal living is not about extreme deprivation. It is about structured money management. It is about reducing waste, planning accurately, and building long-term stability. Families that apply practical frugal systems often save 15–30% of their monthly income without lowering their quality of life.

This guide breaks down proven cost reduction strategies, accurate budget planning methods, and practical systems that work in real households. You will see measurable examples, annual savings projections, and realistic frameworks designed for families — not theory.

What Does Frugal Living Really Mean for Families?

Frugal living for families means managing money with structure, reducing waste, and aligning spending with long-term priorities. It is not about restriction. It is about control. Families that apply practical frugal systems improve savings, reduce financial stress, and create stability without lowering their quality of life.

Frugal vs. Cheap — What Is the Difference?

Frugal means spending money intentionally to maximize long-term value, while cheap means choosing the lowest upfront cost regardless of quality or durability. Frugal families evaluate cost per use, reliability, and total ownership cost. Cheap purchases often lead to frequent replacements, increasing long-term household expenses instead of reducing them.

Frugality focuses on value and sustainability. Cheap behavior focuses only on price. One builds financial stability. The other creates hidden costs.

Why Frugal Thinking Reduces Total Household Expenses

Frugal thinking reduces total household expenses by focusing on long-term value instead of lowest upfront price. By evaluating cost per use, durability, and total ownership cost, families avoid frequent replacements and hidden maintenance expenses. This value-based spending approach lowers lifetime costs and strengthens overall financial stability.

Cost Per Use Analysis

Frugal families calculate cost per use before buying. A $120 winter coat worn for five years costs less annually than replacing a $50 coat every year. Long-term value reduces total spending.

Durability Over Discounts

Low prices can signal lower quality. Replacing broken items repeatedly increases lifetime cost. Reliable products reduce repair, replacement, and maintenance expenses.

How Cheap Spending Increases Long-Term Costs

Cheap spending increases long-term costs because low-quality purchases often require frequent replacement, repairs, or upgrades. While the upfront price is lower, the total ownership cost rises over time. Families that prioritize price alone typically spend more annually than those who evaluate durability, reliability, and cost per use.

The Replacement Cycle Problem

Cheap appliances, shoes, or furniture often fail faster. Replacing items every 6–12 months multiplies total spending.

Hidden Ownership Costs

Cheap purchases may require more maintenance, repairs, or upgrades. Total ownership cost includes energy usage, durability, and lifespan.

How Frugal Families Apply Value-Based Spending

Frugal families apply value-based spending by evaluating necessity, durability, and long-term cost before purchasing. Instead of choosing the cheapest option, they calculate cost per use and total ownership cost. This disciplined decision-making reduces replacement cycles, prevents impulse buying, and lowers overall household expenses over time.

Evaluating Need Before Price

Frugal living tips for families prioritize necessity first. If an item is not needed, even a low price is waste.

Balancing Quality and Budget

Frugal families do not overpay for luxury branding. They look for reliability at a fair price point.

What Does a Frugal Family Lifestyle Actually Look Like?

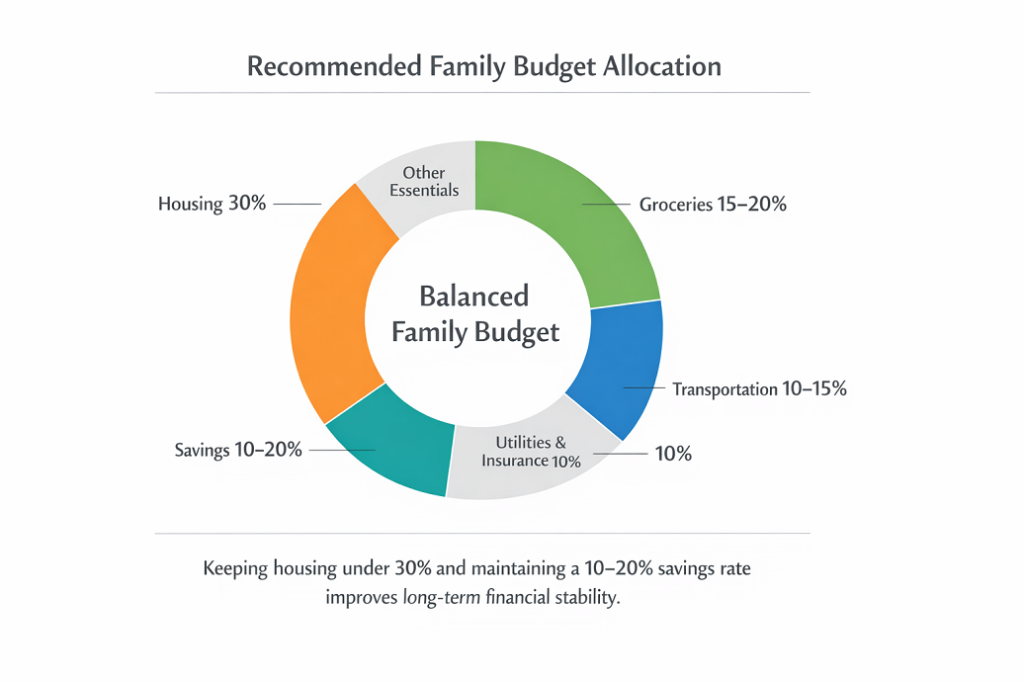

A frugal family lifestyle means living below your income, planning expenses in advance, controlling major spending categories like housing and groceries, and maintaining a consistent savings rate. Frugal families typically save 10–20% of income, track spending weekly, and avoid lifestyle inflation while maintaining comfort and stability.

Frugality is structured, not restrictive. It is disciplined, not extreme.

Budget for a Family of Four — Realistic Expense Breakdown

A typical family of four may allocate 25–35% of income to housing, 15–20% to groceries, 10–15% to transportation, and 10% or more to insurance and utilities. Without structured tracking, these categories expand.

Fixed vs. Variable Expenses

Fixed expenses include rent or mortgage, insurance, and loan payments. Variable expenses include groceries, dining, fuel, and entertainment. Frugal families monitor variable categories closely because they offer the most control.

Where Most Families Overspend

Food, subscriptions, and impulse purchases represent the largest spending leaks. Small recurring digital charges and frequent dining out often add thousands annually without notice.

Why Frugal Living Matters More in 2026

Frugal living matters more in 2026 because inflation, rising grocery prices, higher insurance costs, and expanding subscription expenses are increasing household financial pressure. Families that use structured budgeting, control variable spending, and maintain a consistent savings rate are better protected against economic uncertainty and unexpected expenses.

Inflation and Rising Household Costs

Inflation increases the cost of groceries, utilities, transportation, and services over time. Without cost reduction strategies, spending rises automatically even if lifestyle stays the same.

Grocery and Utility Price Volatility

Food and energy prices fluctuate. Families without structured grocery planning or energy discipline experience unstable monthly expenses.

The Impact of the Subscription Economy

The subscription economy has normalized automatic billing. Streaming platforms, digital services, and memberships quietly increase recurring monthly costs. Regular audits are now essential.

What Are the Most Common Frugal Living Mistakes Families Make?

Families commonly make frugal living mistakes by cutting essentials instead of waste, failing to track real spending, ignoring irregular annual expenses, and attempting extreme budget cuts too quickly. Without structured budgeting and consistent review, these errors reduce sustainability and often lead to burnout or debt reliance instead of long-term financial stability.

Going Extreme Too Fast

Cutting every expense at once often leads to burnout. Sustainable frugal habits work better than short-term extreme restrictions.

Cutting Essentials Instead of Waste

Reducing nutrition, safety, or necessary insurance coverage weakens long-term stability. Wasteful recurring expenses should be targeted first.

Ignoring Annual and Irregular Expenses

Car repairs, school supplies, holidays, and insurance renewals create budget shocks if not planned monthly through sinking funds.

Not Involving Children in Money Decisions

When children are excluded, spending habits do not improve collectively. Involving kids builds awareness and strengthens discipline.

How Does Frugal Living Simplify Family Life?

Frugal living simplifies family life by reducing financial stress, limiting impulse purchases, and creating clear spending boundaries. When families plan expenses in advance and maintain a consistent savings system, decisions become easier and conflicts decrease. Structured budgeting replaces reactive spending, resulting in less clutter, fewer financial surprises, and greater household stability.

Reduced Financial Stress

Clear budgets and defined savings goals lower anxiety. Families know where money goes each month.

Fewer Impulse Purchases and Clutter

Intentional spending reduces unnecessary consumption. Less clutter means less waste and fewer replacement purchases.

Clear Savings Targets and Stability

A consistent savings rate builds emergency reserves and long-term security. Financial clarity strengthens household stability.

How Do Frugal Families Save Money Every Month?

Frugal families save money every month by tracking real expenses, assigning every dollar a purpose, controlling variable spending weekly, and eliminating recurring waste. With structured budgeting systems, households can increase their savings rate by 10–20% without reducing essential living standards.

Saving monthly is not about income level. It is about discipline and visibility. Families that monitor their largest spending categories consistently create a stable gap between income and expenses. That gap becomes savings.

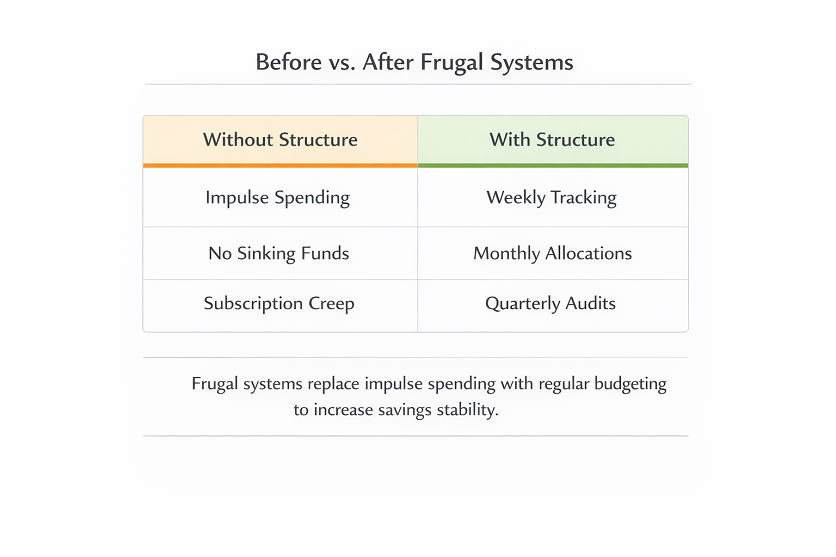

Weekly Budget Tracking System

A weekly budget tracking system helps families control spending by reviewing expenses every seven days instead of waiting until month-end. This approach improves cash flow awareness, prevents early overspending, and allows quick corrections in variable categories like groceries and fuel, increasing overall savings accuracy and financial stability.

Why Weekly Reviews Prevent Overspending

Monthly budgets fail when they are reviewed too late. Weekly tracking allows corrections before small leaks become large deficits. A 15-minute weekly review improves spending awareness immediately.

Breaking Monthly Targets into Weekly Limits

If a family allocates $1,200 for groceries monthly, the weekly limit becomes roughly $300. When weekly caps are enforced, overspending early in the month is avoided.

Zero-Based Budgeting for Families

Zero-based budgeting for families means assigning every dollar of income a specific purpose so that income minus expenses equals zero. Each dollar is allocated to housing, groceries, savings, debt, or sinking funds before the month begins. This method prevents unplanned spending and improves overall financial control.

Assigning Every Dollar a Job

Zero-based budgeting means income minus expenses equals zero. Every dollar is assigned to spending, saving, investing, or sinking funds before the month begins.

Preventing Leftover Money Drift

Unassigned income often turns into impulse spending. Structured allocation prevents waste and strengthens family money management.

Subscription and Recurring Expense Audits

Identifying Automatic Payment Leaks

Streaming services, app subscriptions, and memberships quietly increase monthly expenses. A quarterly audit often reduces recurring costs by $50–$150 per month.

The Impact of the Subscription Economy

Small recurring payments compound. Eliminating $100 per month results in $1,200 annual savings without affecting core living standards.

Controlling Variable Spending Categories

Controlling variable spending categories means setting strict weekly limits for flexible expenses like groceries, dining, fuel, and entertainment. Unlike fixed bills, these costs fluctuate and require active monitoring. Weekly tracking and spending caps prevent budget drift and can reduce total household expenses by 10–20% over time.

Groceries and Dining Discipline

Food is one of the most flexible expense categories. Meal planning and reduced dining out can lower total food spending by 15–25%.

Fuel and Transportation Awareness

Combining errands and maintaining vehicles properly reduces fuel and maintenance costs steadily over time.

Sinking Funds for Irregular Expenses

Sinking funds for irregular expenses are monthly savings allocations set aside for predictable but non-monthly costs like car repairs, holidays, school supplies, and insurance renewals. By dividing annual expenses into manageable monthly amounts, families prevent budget shocks, avoid credit card reliance, and maintain consistent financial stability.

Planning for Annual Costs Monthly

Car repairs, holidays, school supplies, and insurance renewals should be divided into monthly allocations. This prevents budget shocks.

Reducing Financial Stress Through Preparation

When irregular expenses are pre-funded, families avoid credit reliance and maintain stability.

Frugal living tips for families work when systems are repeated consistently. Monthly savings grow from structured weekly control, recurring expense discipline, and accurate allocation. Not extreme cuts. Just steady management.

What Frugal Habits Save the Most Money for Families?

The frugal habits that save the most money for families are cooking at home consistently, structured grocery planning, eliminating recurring subscriptions, buying secondhand first, and tracking spending weekly. These habits target the largest spending categories and can reduce total household expenses by 15–25% annually.

High-impact habits focus on food, recurring bills, and consumption patterns. Small daily discipline in large categories produces measurable annual savings.

Cooking at Home as a Primary Cost Reduction Strategy

Cooking at home is a primary cost reduction strategy because restaurant meals often cost three to five times more than home-prepared food. By replacing just two weekly dining-out trips with planned home meals, families can save $4,000–$6,000 annually while maintaining nutrition and improving overall budget control.

Replacing Restaurant Spending

Dining out two times per week at $70 per visit costs roughly $560 per month. Replacing those meals with planned home cooking can cut that expense by more than half.

Annual Savings Projection

Reducing restaurant frequency alone can preserve $4,000–$6,000 per year for a family of four.

Structured Grocery Planning

Structured grocery planning means creating a weekly meal plan, setting a spending cap, and shopping with a detailed list based on sales and pantry inventory. This system reduces impulse purchases, limits food waste, and can lower grocery costs by 10–25% annually for a family of four.

Weekly Meal Planning System

Planning seven meals before shopping prevents impulse buying and midweek takeout. Grocery budgets become predictable.

Reducing Food Waste

Wasted groceries often exceed $25–$40 per week. Reducing waste adds $1,300–$2,000 in annual savings.

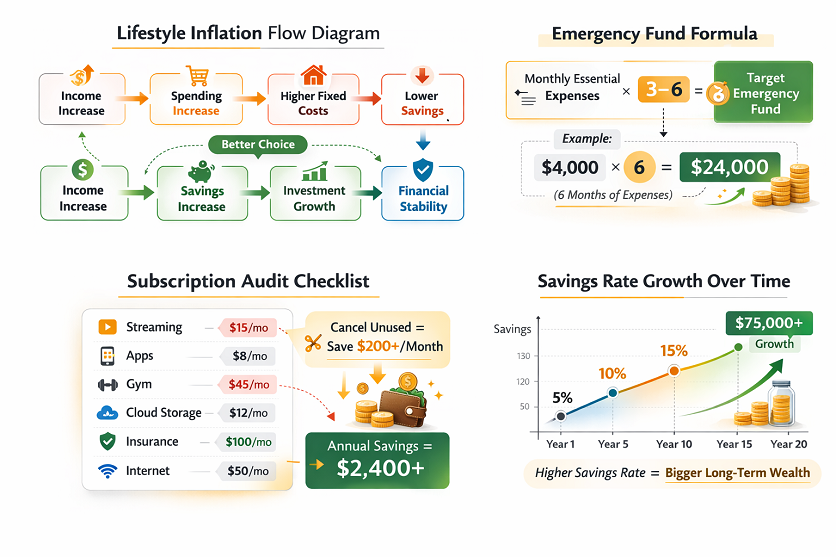

Eliminating Recurring Subscriptions

Eliminating recurring subscriptions reduces household expenses by removing automatic monthly charges for unused streaming services, apps, memberships, and digital tools. A quarterly subscription audit can cut $50–$150 per month, freeing $600–$1,800 annually without affecting essential living standards or overall quality of life.

Quarterly Subscription Audit

Streaming platforms, app memberships, and digital services often overlap. Removing $80 per month in unused services saves nearly $1,000 per year.

Preventing Subscription Creep

Reviewing automatic payments every quarter prevents silent spending growth.

Buying Secondhand First

Buying secondhand first reduces household expenses by purchasing gently used clothing, furniture, books, and equipment at 40–70% below retail prices. Prioritizing resale markets before buying new lowers consumption costs, prevents rapid depreciation losses, and strengthens long-term family budget control.

Children’s Clothing and Household Goods

Children outgrow clothing quickly. Purchasing gently used items reduces spending by 40–70% compared to retail pricing.

Long-Term Consumption Discipline

Applying a “secondhand first” rule across furniture, books, and sports equipment creates steady savings.

Weekly Spending Awareness

Weekly spending awareness means reviewing all discretionary and variable expenses every seven days to prevent budget drift. By tracking groceries, dining, fuel, and small purchases weekly, families reduce impulse spending and can save $100 or more per week, improving annual financial stability significantly.

Tracking Variable Categories

Groceries, fuel, and discretionary purchases require weekly review. Awareness alone reduces impulse spending.

Savings Rate Impact

A modest $100 weekly reduction in unnecessary spending equals $5,200 annually.

Frugal living tips for families work best when habits are repetitive and focused on major cost drivers. Cooking, planning, auditing, buying used, and tracking spending create predictable financial margins. Over time, these habits form the backbone of a stable frugal family lifestyle.

How Can Families Cut Monthly Expenses Fast?

Families can cut monthly expenses fast by eliminating unnecessary recurring payments, reducing dining out, restructuring grocery spending, negotiating service bills, and enforcing a short-term spending reset. Targeting the largest expense categories first can reduce household spending by $300–$800 per month within one billing cycle.

Fast savings come from decisive action, not small cuts.

Immediate Subscription and Recurring Expense Cuts

Immediate subscription and recurring expense cuts involve canceling unused streaming services, memberships, apps, and automatic renewals within one billing cycle. By targeting recurring charges first, families can reduce monthly expenses by $100–$300 quickly, improving cash flow and strengthening short-term financial stability.

Canceling Unused Services

Streaming platforms, premium apps, delivery memberships, and unused subscriptions often total $50–$150 per month. Removing them creates instant cash flow improvement.

Quarterly Recurring Expense Review

Recurring payments should be reviewed every 90 days. This prevents silent spending growth and protects long-term budget accuracy.

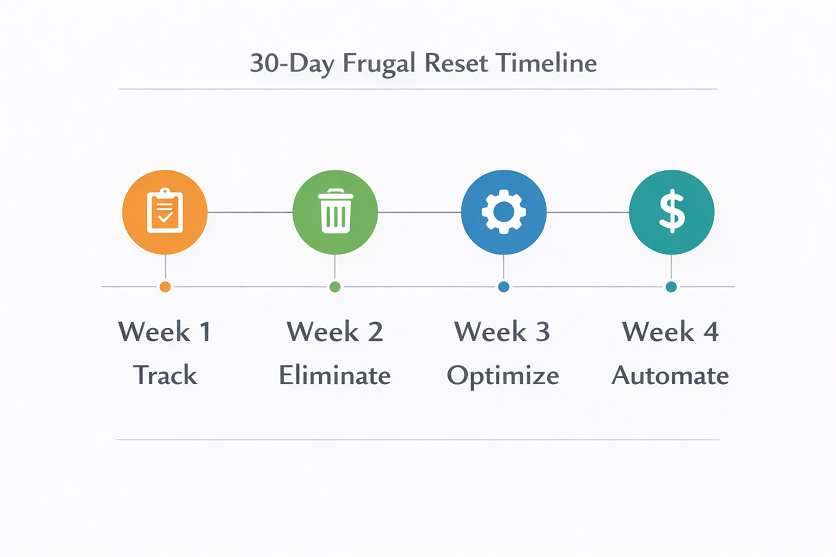

Temporary 30-Day Spending Reset

A temporary 30-day spending reset eliminates all non-essential purchases for one month, limiting expenses to housing, utilities, groceries, and transportation. This short-term discipline reveals spending leaks, improves cash flow awareness, and can generate $500–$1,000 in immediate savings while rebuilding long-term financial control.

Stopping Non-Essential Purchases

For 30 days, limit spending to housing, utilities, groceries, fuel, and insurance. No impulse purchases. No dining out. This reveals hidden spending patterns quickly.

Resetting Financial Behavior

A short reset improves awareness and often produces $500 or more in immediate monthly savings.

Reducing Food Costs Quickly

Reducing food costs quickly requires cutting dining out, planning weekly meals around discounts, using pantry inventory first, and switching to lower-cost store brands. These changes can reduce grocery and restaurant spending by 15–30% within one month, creating immediate budget relief for families.

Replacing Dining Out With Meal Planning

If a family spends $700 per month eating out, reducing that by half produces $350 in fast savings.

Using Pantry and Freezer Inventory

A one-week pantry challenge reduces grocery purchases and prevents food waste.

Negotiating Monthly Service Bills

Negotiating monthly service bills involves contacting providers for internet, insurance, mobile, and cable services to request discounts, loyalty credits, or plan adjustments. A single negotiation can reduce bills by $20–$60 per month, saving $240–$720 annually without changing essential services or household comfort.

Internet, Insurance, and Mobile Plans

Service providers frequently offer retention discounts. A single negotiation call can reduce bills by $20–$60 per month.

Annual Insurance Comparison

Shopping insurance yearly prevents loyalty penalties and often lowers premiums.

Energy and Utility Adjustments

Energy and utility adjustments reduce household expenses by lowering heating and cooling settings, switching to LED lighting, and minimizing idle electricity use. Small efficiency changes can cut utility bills by 5–15%, saving hundreds annually while maintaining comfort and improving overall budget control.

Thermostat Optimization

Adjusting heating and cooling settings by a few degrees can reduce energy bills by 5–10%.

Reducing Idle Electricity Use

Switching to LED lighting and unplugging unused electronics reduces unnecessary consumption.

Frugal living tips for families work fastest when the focus stays on high-impact categories. Cutting a few small expenses helps, but restructuring food, subscriptions, and utilities produces measurable results immediately.

Quick reductions create breathing room. Long-term systems create stability.

How Can Families Save Money on Groceries for a Family of Four?

Families can save money on groceries for a family of four by using weekly meal planning, buying store brands, reducing food waste, tracking price per unit, and limiting impulse purchases. With consistent systems, grocery spending can drop 10–25%, often saving $1,500–$3,000 per year.

Groceries are one of the largest controllable household expenses. Structure makes the difference.

Weekly Meal Planning System

A weekly meal planning system involves selecting seven planned meals before grocery shopping, building a list around sales and pantry inventory, and setting a clear spending limit. This structured approach reduces impulse purchases, prevents midweek takeout, and can lower monthly grocery costs by 10–20%.

Planning Before Shopping

Building a 7-day meal plan before entering the store reduces impulse buying and midweek takeout. Families shop with purpose, not emotion.

Setting a Weekly Grocery Cap

If the monthly food budget is $1,200, the weekly limit should stay near $300. Weekly control prevents early overspending.

Using Store Brands and Cost-Per-Unit Comparison

Using store brands and cost-per-unit comparison helps families reduce grocery expenses by choosing lower-priced alternatives with similar quality. Comparing price per ounce or pound instead of package price prevents misleading bulk purchases. This strategy can lower monthly grocery costs by 10–20% without sacrificing nutrition or product reliability.

Why Brand Loyalty Increases Costs

National brands often cost 15–30% more than store brands with minimal quality difference.

Tracking Price Per Ounce or Pound

Comparing cost per unit instead of package price prevents misleading bulk purchases.

Reducing Food Waste

Reducing food waste lowers grocery expenses by ensuring purchased food is fully used before spoiling. By planning meals around existing pantry items, storing food properly, and repurposing leftovers, families can prevent $25–$50 in weekly waste, saving $1,300–$2,600 annually while improving overall budget efficiency.

Using Pantry and Freezer Inventory First

Many families waste $25–$40 per week in unused food. A pantry-first rule cuts unnecessary duplication.

Monthly Pantry Reset Week

One week per month using mostly stored food balances inventory and lowers grocery totals.

Smarter Protein and Ingredient Rotation

Smarter protein and ingredient rotation reduces grocery costs by replacing high-priced meats with lower-cost options like beans, lentils, eggs, and seasonal proteins several times per week. Rotating affordable ingredients can lower monthly food expenses by 10–15% while maintaining balanced nutrition and consistent meal quality.

Lower-Cost Protein Substitutions

Rotating beans, lentils, eggs, and seasonal proteins two nights per week reduces food costs without lowering nutrition.

Cooking in Batches

Batch cooking prevents convenience purchases and reduces per-meal cost.

Limiting Impulse Purchases

Limiting impulse purchases reduces unnecessary spending by using a written shopping list, setting a weekly budget cap, and avoiding emotional buying triggers. Even cutting $20–$30 in unplanned purchases per trip can save $1,000 or more annually, improving overall household financial control and savings consistency.

Shopping With a Written List

Entering the store without a list increases unplanned spending significantly.

Avoiding Hungry Shopping

Impulse purchases rise when shopping hungry. Timing matters.

Frugal living tips for families often begin with grocery control because the savings are immediate and measurable. Even a modest 15% reduction on a $1,100 monthly food budget equals nearly $2,000 annually.

Structure beats restriction. Planning beats impulse.

How Do Frugal Families Create an Accurate Family Budget That Actually Works?

Frugal families create an accurate family budget by tracking real spending first, separating fixed and variable expenses, assigning every dollar a job, and reviewing the budget weekly. When built on actual numbers instead of estimates, a working budget can increase savings by 10–20% within months.

Accuracy starts with data, not assumptions.

Tracking Real Spending Before Budgeting

Tracking real spending before budgeting means reviewing 60–90 days of bank and credit card transactions to identify actual expense patterns. This prevents underestimating categories like groceries, dining, and subscriptions. Accurate data creates realistic budget limits and can improve savings rates by 10–20% within months.

Reviewing 60–90 Days of Transactions

Bank and credit card statements reveal true spending patterns. Most families underestimate groceries, dining, and small recurring charges.

Identifying Spending Leaks

Subscriptions, impulse purchases, and convenience spending often add hundreds monthly without awareness.

Separating Fixed and Variable Expenses

Separating fixed and variable expenses helps families control spending by identifying which costs are stable and which can be adjusted. Fixed expenses include housing and insurance, while variable expenses include groceries and dining. Managing variable categories weekly can reduce total household spending by 10–15% over time.

Fixed Costs First

Housing, insurance, loan payments, and utilities form the non-negotiable base of the budget.

Controlling Variable Categories

Groceries, dining, fuel, clothing, and entertainment require weekly caps because they fluctuate.

Using Zero-Based Budgeting

Using zero-based budgeting means assigning every dollar of income to a specific category—such as housing, groceries, savings, or debt—so that income minus expenses equals zero. This structured method prevents leftover cash from turning into impulse spending and improves monthly financial control and savings consistency.

Assigning Every Dollar a Purpose

Income minus expenses should equal zero. Every dollar must go toward spending, saving, investing, or sinking funds.

Preventing Leftover Drift

Unassigned money often turns into unplanned spending. Structure prevents this.

Building Sinking Funds for Irregular Costs

Building sinking funds for irregular costs means saving small monthly amounts for predictable but non-monthly expenses like car repairs, holidays, medical bills, and school supplies. Dividing annual costs into monthly contributions prevents financial shocks, reduces credit card reliance, and strengthens long-term household budget stability.

Dividing Annual Expenses Monthly

Car repairs, holidays, school supplies, and insurance renewals should be funded monthly to avoid budget shocks.

Improving Financial Stability

Pre-funding irregular costs reduces reliance on credit and lowers stress.

Weekly Budget Reviews

Weekly budget reviews involve checking all spending categories every seven days to compare actual expenses against planned limits. This habit prevents early overspending, improves cash flow control, and allows quick corrections in groceries, dining, and discretionary spending, strengthening overall financial discipline and savings consistency.

Why Monthly Reviews Are Too Late

Checking the budget once a month delays corrections. Weekly reviews allow early adjustments.

Maintaining Budget Discipline

A 15-minute weekly review protects spending limits and improves consistency.

Frugal living tips for families depend on clarity and repetition. A budget works when it reflects real numbers, includes irregular expenses, and is reviewed consistently.

Not complex. Just disciplined.

How Can Families Reduce Household Expenses Without Sacrificing Quality of Life?

Families reduce household expenses without sacrificing quality of life by cutting waste instead of essentials, replacing high-cost activities with lower-cost alternatives, and improving efficiency in food, utilities, and subscriptions. When spending is optimized rather than eliminated, households can lower costs by 10–20% while maintaining comfort and stability.

The goal is precision, not restriction.

Replacing, Not Removing, Entertainment

Replacing, not removing, entertainment means swapping high-cost activities like frequent dining out or paid events with lower-cost alternatives such as library programs, park outings, and home movie nights. This strategy reduces discretionary spending by hundreds per month while preserving family connection and overall quality of life.

Affordable Family Activities

Library programs, park outings, game nights, and community events replace high-cost entertainment without reducing enjoyment.

No-Spend Weekend Strategy

Two planned no-spend weekends per month can reduce discretionary spending significantly while strengthening family time.

Optimizing Food Without Lowering Quality

Optimizing food without lowering quality means reducing grocery costs through meal planning, seasonal buying, store brands, and minimizing waste while maintaining balanced nutrition. By focusing on efficiency instead of restriction, families can lower food expenses by 10–20% without sacrificing health, taste, or meal variety.

Meal Planning Over Restriction

Structured meal planning reduces grocery costs without cutting nutrition.

Reducing Dining Out Frequency

Lowering restaurant visits while maintaining occasional planned outings preserves balance.

Managing Utilities and Energy Efficiently

Managing utilities and energy efficiently means adjusting thermostat settings, reducing idle electricity use, sealing air leaks, and using energy-efficient lighting and appliances. These practical changes can lower monthly utility bills by 5–15%, saving hundreds annually while maintaining household comfort and long-term cost stability.

Thermostat and Usage Adjustments

Small heating and cooling adjustments reduce bills without noticeable discomfort.

Energy-Efficient Upgrades

LED lighting and smart usage habits improve long-term cost control.

Controlling Subscription and Service Costs

Controlling subscription and service costs means regularly reviewing streaming platforms, apps, internet plans, insurance policies, and memberships to eliminate unused or overpriced services. A quarterly audit can reduce recurring expenses by $50–$200 per month, improving cash flow and strengthening long-term household budget stability.

Keeping Only High-Value Services

Retaining only actively used subscriptions prevents recurring waste.

Negotiating and Comparing Providers

Annual service reviews often reduce insurance and internet costs without changing quality.

Maintaining Value-Based Purchasing

Maintaining value-based purchasing means choosing products based on durability, necessity, and long-term cost per use rather than lowest upfront price. By prioritizing quality and reliability, families reduce replacement cycles, avoid hidden ownership costs, and lower total household spending over time.

Cost Per Use Thinking

Spending more on durable essentials often reduces long-term replacement costs.

Avoiding the Cheap Replacement Cycle

Quality purchases prevent frequent repurchasing.

Frugal living tips for families work best when large categories are optimized, not eliminated. Comfort, nutrition, safety, and meaningful experiences remain intact. Waste is removed. Efficiency improves.

Financial pressure decreases without lifestyle sacrifice.

How Do Frugal Families Avoid Lifestyle Inflation?

Frugal families avoid lifestyle inflation by keeping core expenses stable as income rises, increasing their savings rate with every raise, and delaying major upgrades until they are financially justified. This discipline allows income growth to strengthen long-term wealth instead of expanding monthly obligations.

Lifestyle inflation happens quietly. Income increases. Spending follows.

Increasing Savings Before Increasing Spending

Increasing savings before increasing spending means directing raises or extra income toward savings, debt reduction, or investments before upgrading lifestyle expenses. By allocating at least 50% of income growth to long-term goals, families prevent lifestyle inflation and strengthen financial stability over time.

Allocating Raises Strategically

When income rises, disciplined families direct at least 50% of the increase toward savings, investments, or debt reduction before adjusting lifestyle expenses.

Protecting the Savings Rate

Maintaining or increasing the household savings rate prevents income growth from disappearing into higher consumption.

Delaying Major Lifestyle Upgrades

Delaying major lifestyle upgrades means waiting 60–90 days before purchasing a larger home, newer vehicle, or high-cost item to evaluate long-term affordability. This pause reduces emotional spending, prevents fixed expense increases, and protects a family’s savings rate from unnecessary lifestyle inflation.

60–90 Day Upgrade Rule

Waiting before upgrading homes, vehicles, or major purchases reduces emotional spending decisions.

Evaluating Total Cost of Ownership

Higher housing or vehicle costs include insurance, maintenance, taxes, and utilities. Frugal families calculate the full long-term impact before committing.

Maintaining Budget Discipline After Income Growth

Maintaining budget discipline after income growth means keeping core expenses stable, reviewing spending categories carefully, and increasing savings automatically before expanding lifestyle costs. This prevents income raises from turning into higher fixed obligations and helps families strengthen long-term financial stability instead of inflating monthly expenses.

Reviewing Expense Categories Carefully

Income growth does not automatically require category expansion. Variable spending is adjusted intentionally, not automatically.

Avoiding Automatic Lifestyle Creep

Small upgrades across multiple categories often raise fixed expenses permanently.

Teaching Income Discipline to Children

Teaching income discipline to children means showing them that earning more does not automatically justify spending more. By modeling saving first, setting spending limits, and explaining long-term financial goals, families help children develop responsible money habits and avoid lifestyle inflation as their income grows.

Modeling Financial Restraint

Children who see controlled spending despite income growth learn long-term discipline.

Preventing Entitlement Spending Patterns

Family discussions about income and savings reinforce responsible expectations.

Frugal living tips for families protect income growth by creating a gap between earnings and expenses. When income rises and spending stays stable, savings accelerate.

Lifestyle inflation is natural. Discipline prevents it.

How Do Families Build Long-Term Financial Stability Through Frugal Living?

Families build long-term financial stability through frugal living by maintaining a consistent savings rate, eliminating high-interest debt, planning for irregular expenses, and investing surplus income systematically. Stability comes from disciplined cash flow management, not income alone.

Frugality creates the margin. Planning protects it.

Building a Fully Funded Emergency Reserve

Building a fully funded emergency reserve means saving three to six months of essential living expenses in a dedicated account to cover unexpected events like job loss or medical bills. This financial buffer prevents debt reliance, protects long-term stability, and reduces household stress during economic uncertainty.

Three to Six Months of Essential Expenses

Financially stable households aim to hold three to six months of core living expenses in cash. This prevents unexpected events from turning into debt.

Starting With a $1,000 Foundation

Even a small emergency buffer reduces financial stress and protects against short-term disruptions.

Eliminating High-Interest Consumer Debt

Eliminating high-interest consumer debt means prioritizing repayment of credit cards and loans with interest rates above 15–20%. Paying off these balances reduces total interest paid, frees monthly cash flow, and provides an immediate guaranteed return equal to the interest rate, strengthening long-term financial stability.

Prioritizing Credit Card Balances

Interest rates above 15–20% erase savings progress quickly. Paying off high-interest debt creates an immediate financial return equal to the interest rate.

Freeing Monthly Cash Flow

Debt elimination lowers fixed obligations and increases flexibility.

Using Sinking Funds for Predictable Annual Costs

Using sinking funds for predictable annual costs means setting aside small monthly amounts for expenses like holidays, car maintenance, insurance renewals, and school supplies. Dividing yearly costs into manageable monthly contributions prevents financial surprises, reduces credit card reliance, and keeps the family budget stable year-round.

Dividing Irregular Expenses Monthly

Car repairs, holidays, school costs, and insurance renewals should be saved for monthly to prevent financial shocks.

Avoiding Credit Dependence

Pre-funded expenses reduce reliance on credit cards during high-cost months.

Maintaining a Sustainable Savings Rate

Maintaining a sustainable savings rate means consistently setting aside 10–20% of household income for emergencies, future goals, and investments. By automating transfers and controlling variable spending, families protect long-term financial stability and build resilience against income changes, inflation, and unexpected expenses.

Targeting 10–20% When Possible

A consistent savings rate strengthens financial resilience over time. Even gradual improvement compounds.

Automating Transfers

Automatic transfers to savings or investment accounts remove decision fatigue.

Investing for Long-Term Growth

Investing for long-term growth means regularly contributing to retirement accounts, index funds, or diversified portfolios to benefit from compound returns over time. Consistent investing, even in small amounts, allows families to build wealth gradually, outpace inflation, and strengthen long-term financial security.

Employer-Sponsored Retirement Plans

Contributing enough to capture employer matching accelerates long-term growth.

Allowing Compound Growth to Work

Early and consistent investing multiplies the impact of disciplined saving.

Frugal living tips for families support long-term stability by reducing waste and protecting surplus income. When spending remains controlled and savings remain consistent, financial strength builds steadily.

Stability is not built in one year. It is built through repeated disciplined months.

How Can Families Teach Kids About Money and Frugality?

Families teach kids about money and frugality by modeling disciplined spending, involving them in budgeting decisions, giving structured allowance systems, and teaching delayed gratification. When children participate in real financial discussions, they develop lifelong money management skills early.

Kids learn from what they see more than what they’re told.

Making the Family Budget Visible

Making the family budget visible means openly sharing income, expenses, and savings goals with all household members. Displaying monthly spending categories and financial targets increases accountability, improves money awareness, and helps children and adults understand how daily decisions affect long-term financial stability.

Explaining Real Household Costs

Showing children how much groceries, utilities, and housing cost builds awareness. Numbers make money real.

Letting Kids Participate in Planning

Allowing children to help plan grocery lists or compare prices teaches practical spending discipline.

Using a Structured Allowance System

Using a structured allowance system means giving children a fixed amount of money divided into spending, saving, and giving categories. This approach teaches budgeting, delayed gratification, and financial responsibility early, helping kids understand money management principles before they begin earning larger incomes.

Dividing Money Into Categories

A simple system divides allowance into spending, saving, and giving. This builds balance early.

Connecting Money to Responsibility

Linking allowance to chores or accountability reinforces value exchange.

Teaching Delayed Gratification

Teaching delayed gratification means encouraging children to save for desired items instead of buying immediately. This builds patience, strengthens decision-making, and reduces impulse spending habits. Learning to wait before purchasing helps children understand opportunity cost and supports long-term financial discipline.

Saving Before Buying

Encouraging children to save toward a desired item builds patience and financial control.

Understanding Opportunity Cost

When money is spent on one item, it cannot be spent elsewhere. This lesson strengthens decision-making.

Involving Kids in Cost Reduction Goals

Involving kids in cost reduction goals means including them in family savings challenges, grocery budgeting, and energy-saving efforts. Participation builds financial awareness, accountability, and teamwork. When children understand why expenses are controlled, they develop responsible money habits and contribute to long-term household stability.

No-Spend Weekend Participation

Making frugal challenges a family effort builds cooperation instead of resistance.

Energy and Waste Awareness

Teaching children to reduce waste reinforces shared responsibility.

Introducing Teens to Real Financial Tools

Introducing teens to real financial tools means helping them open savings accounts, track spending digitally, understand credit basics, and learn simple investing concepts. Early hands-on experience builds financial literacy, improves money management skills, and prepares teens for independent financial responsibility in adulthood.

Opening Basic Savings Accounts

Early exposure to banking builds familiarity and confidence.

Explaining Compound Growth Simply

Showing how small savings grow over time builds long-term thinking.

Frugal living tips for families become stronger when they become cultural habits. Children raised in financially structured homes are more likely to avoid debt, manage income wisely, and build stability as adults.

Teaching money is not restriction. It is preparation.

What Frugal Living Strategies Work Best in 2026?

The frugal living strategies that work best in 2026 combine traditional budgeting discipline with digital expense tracking, subscription control, price comparison tools, and automated savings systems. Families who measure spending in real time and protect their savings rate adapt better to rising costs and economic shifts.

Modern frugality is structured and tech-assisted.

Digital Budget Tracking Systems

Digital budget tracking systems help families monitor income and expenses in real time using apps or spreadsheets. Weekly tracking improves cash flow visibility, prevents overspending, and strengthens savings consistency. Real-time expense monitoring reduces financial surprises and increases overall household budget accuracy.

Real-Time Expense Monitoring

Budgeting apps and digital spreadsheets allow families to track spending weekly instead of waiting for month-end statements.

Preventing End-of-Month Surprises

Immediate visibility reduces overspending and improves savings consistency.

Subscription Economy Control

Subscription economy control means actively reviewing and managing recurring digital services such as streaming platforms, apps, delivery memberships, and software subscriptions. Conducting quarterly audits prevents automatic payment creep, reduces monthly expenses by $50–$200, and protects long-term household budget stability.

Quarterly Subscription Audits

Streaming services, apps, delivery memberships, and software platforms accumulate quickly. Regular audits prevent silent cost growth.

Reducing Automatic Payment Drift

Even eliminating $100 per month in unused subscriptions preserves $1,200 annually.

Cashback and Discount Stacking

Cashback and discount stacking means combining credit card rewards, store promotions, coupons, and loyalty programs on the same purchase to maximize savings. When used strategically, this method can return 1–5% of total spending annually, reducing overall household expenses without changing buying habits.

Combining Store Promotions and Rewards

Using cashback cards with loyalty programs creates small percentage returns that compound yearly.

Tracking Real Savings

1–5% return across major spending categories builds incremental savings without changing lifestyle.

Flexible Grocery Planning in a Volatile Market

Flexible grocery planning in a volatile market means adjusting weekly meal plans based on current prices, seasonal availability, and store discounts instead of fixed menus. This adaptive approach reduces exposure to price spikes, stabilizes food budgets, and can lower grocery expenses by 10–20% during inflationary periods.

Adapting to Weekly Discounts

Food prices fluctuate. Planning meals around current promotions stabilizes grocery budgets.

Seasonal and Local Buying

Seasonal products typically cost less and reduce total grocery spend.

Automated Savings and Investment Transfers

Automated savings and investment transfers move a fixed percentage of income into savings or investment accounts immediately after each paycheck. This “pay yourself first” strategy removes spending temptation, increases savings consistency, and helps families build long-term financial security without relying on willpower.

Paying Yourself First

Automatic transfers to savings accounts protect surplus income before spending begins.

Increasing Savings With Income Growth

When income rises, automation prevents lifestyle inflation.

The 30-Day Frugal Reset Challenge

The 30-Day Frugal Reset Challenge is a short-term plan that eliminates non-essential spending for one month to rebuild financial control. By limiting expenses to housing, utilities, groceries, and transportation, families can identify spending leaks, improve cash flow awareness, and save $500–$1,000 quickly.

Short-Term Spending Discipline

A structured 30-day reset eliminates unnecessary purchases and reveals spending patterns.

Rebuilding Financial Control

Short resets strengthen long-term discipline and improve awareness.

Frugal living tips for families in 2026 focus on measurement, automation, and intentional spending. Traditional principles still apply, but digital tools strengthen precision.

Structure wins. Awareness wins. Discipline compounds.

Frequently Asked Questions About Frugal Living for Families

What Is the 50/30/20 Budget Rule for Families?

The 50/30/20 rule allocates 50% of income to needs, 30% to wants, and 20% to savings. For families, this often requires adjustment because housing and childcare can exceed 50%. Many frugal families modify it to 60/20/20 or use zero-based budgeting for greater accuracy and control.

How Much Should a Family of Four Spend on Groceries Per Month?

A family of four typically spends between $900 and $1,300 per month on groceries, depending on location and food choices. Using structured meal planning and reducing food waste can lower that total by 10–25%, saving $1,500 to $3,000 annually without reducing food quality.

Can a Family Live Comfortably on One Income?

Yes, a family can live comfortably on one income with disciplined budgeting, controlled housing costs, structured grocery planning, and limited recurring expenses. The key is maintaining a strong savings rate and avoiding lifestyle inflation as income changes.

What Are the Fastest Ways to Cut Household Expenses?

The fastest ways to cut household expenses include canceling unused subscriptions, reducing dining out, negotiating insurance and internet bills, and enforcing a 30-day spending reset. Targeting high-impact categories first can free $300–$800 per month within one billing cycle.

How Do Frugal Families Save Money Every Month?

Frugal families save money monthly by tracking spending weekly, assigning every dollar a purpose, controlling variable categories like groceries and dining, and funding sinking accounts for irregular expenses. Structured systems typically improve savings rates by 10–20% within months.

Is Frugal Living the Same as Being Cheap?

No. Frugal living focuses on long-term value and intentional spending, while being cheap prioritizes the lowest upfront cost. Frugal families evaluate durability, cost per use, and total ownership cost to reduce overall household expenses sustainably.

What Percentage of Income Should a Family Save?

Financially stable families aim to save 15–20% of income when possible. Even a consistent 10% savings rate builds long-term security. Automated transfers and controlled spending help maintain this target without sacrificing essential living standards.

How Do Families Avoid Living Paycheck to Paycheck?

Families avoid living paycheck to paycheck by reducing recurring expenses, building a small emergency fund, tracking weekly spending, and increasing their savings margin. Even eliminating $200–$400 in monthly waste can create immediate breathing room and financial stability.

What Are the Best Frugal Habits for Long-Term Wealth?

The best frugal habits for building long-term wealth include cooking at home, consistent budget tracking, avoiding high-interest debt, buying secondhand when practical, and investing surplus income regularly. These habits create a sustainable gap between income and expenses.

Final Thoughts on Building a Sustainable Frugal Family Lifestyle

Frugal living tips for families are not about restriction. They are about structure, clarity, and long-term stability. When families control major spending categories, track expenses weekly, and protect their savings rate, financial stress decreases and confidence increases.

The goal is not extreme frugal living. It is disciplined money management. Cooking at home, planning groceries, eliminating recurring waste, avoiding lifestyle inflation, and maintaining an accurate budget create a predictable financial margin.

That margin becomes an emergency fund.

It becomes debt freedom.

It becomes long-term investment growth.

Families that apply these systems consistently often reduce household expenses by 15–25% annually without lowering their quality of life. The difference is not income level. It is awareness and repetition.

Start with one category. Improve it. Then move to the next.

Small controlled changes compound.

A structured frugal family lifestyle builds security, reduces pressure, and turns income into stability instead of stress.

That is the long-term value of disciplined frugal living.